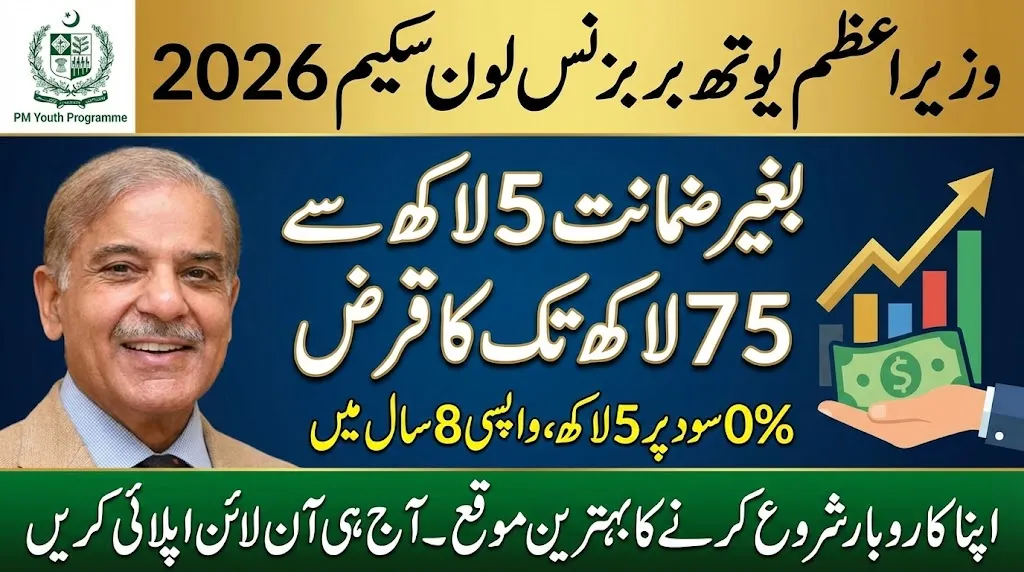

The Government of Pakistan has officially opened PM Youth Business Loan 2026 online applications, giving young entrepreneurs across the country a fresh opportunity to start or expand their own businesses. Under the Prime Minister’s Youth Programme, this flagship financing scheme aims to promote self-employment, support startups, and reduce unemployment by providing easy, low-markup loans to eligible youth.

If you are planning to launch a small business or grow an existing one, this complete guide explains how to apply online for PM Youth Business Loan 2026, eligibility criteria, loan amounts, markup rates, repayment terms, required documents, and how to track your application status.

What Is PM Youth Business Loan Scheme?

The Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) is a federal initiative launched to provide affordable financing to young men and women who want to become entrepreneurs. The scheme is implemented through major commercial banks and microfinance institutions across Pakistan.

The main objectives include:

- Encouraging youth entrepreneurship

- Supporting startups and small enterprises

- Creating employment opportunities

- Promoting women-led businesses

- Strengthening the SME sector

For 2026, the government has continued the program with updated limits and an improved online application system.

Loan Categories and Amounts in PM Youth Business Loan 2026

The scheme offers loans in different tiers based on business needs.

Tier 1 (T1):

- Loan amount: From Rs. 100,000 to Rs. 500,000

- Markup rate: 0 percent (interest-free)

Tier 2 (T2):

- Loan amount: From Rs. 500,001 to Rs. 1.5 million

- Markup rate: Low subsidized rate

Tier 3 (T3):

- Loan amount: From Rs. 1.5 million to Rs. 7.5 million

- Markup rate: Market-based with government subsidy

The repayment period can extend up to 8 years, with a possible grace period at the start.

Eligibility Criteria for PM Youth Business Loan 2026

To apply online, you must meet the following conditions:

- Pakistani citizen with valid CNIC

- Age between 21 and 45 years

- For IT and tech-related businesses, minimum age is 18 years

- Must have a viable business plan or existing business

- Both men and women can apply

- Special quota reserved for women, minorities, and differently-abled persons

Students, fresh graduates, and self-employed individuals are also encouraged to apply.

How to Apply Online for PM Youth Business Loan 2026

The government has made the application process fully online and simple.

Step 1: Visit Official Portal

Go to the official PM Youth Loan portal under the Prime Minister’s Youth Programme website.

Step 2: Create an Account

Register using your CNIC number, mobile number, and email address.

Step 3: Fill Online Application Form

Enter details about:

- Personal information

- Education and experience

- Business type and location

- Required loan amount

- Estimated income and expenses

Step 4: Upload Required Documents

Upload scanned copies of:

- CNIC

- Passport-size photograph

- Educational certificates (if any)

- Business plan or proposal

Step 5: Submit Application

After submission, you will receive an application tracking number.

Banks Participating in PM Youth Loan Scheme

The scheme is implemented through leading banks including:

- National Bank of Pakistan

- Habib Bank Limited (HBL)

- United Bank Limited (UBL)

- MCB Bank

- Bank of Punjab

- Allied Bank

- First Women Bank

- Microfinance banks

Your application is forwarded to the selected bank for verification and processing.

How to Check PM Youth Business Loan Application Status

You can track your application easily:

- Log in to the PM Youth Loan portal

- Enter your CNIC or tracking ID

- Check current status (under review, approved, rejected, or pending)

The bank may also contact you for interview or additional documents.

Common Reasons for Rejection

Many applications are delayed or rejected due to:

- Incomplete application form

- Weak or unclear business plan

- Incorrect income information

- Poor credit history

- Missing documents

Providing accurate details and a realistic business plan improves approval chances.

Benefits of PM Youth Business Loan 2026

- Easy online application

- Low or zero markup options

- Long repayment period

- Government-backed security

- Special support for women entrepreneurs

- No hidden charges

This scheme is considered one of the best financing options for young entrepreneurs in Pakistan.

FAQs – PM Youth Business Loan

1. Who can apply for PM Youth Business Loan 2026?

Pakistani citizens aged 21 to 45 with a valid CNIC and a viable business idea or existing business can apply.

2. How can I apply online for PM Youth Business Loan 2026?

You can apply through the official Prime Minister’s Youth Programme loan portal by filling the online application form.

3. What is the maximum loan amount under this scheme?

Applicants can get up to Rs. 7.5 million depending on the loan tier and business requirements.

4. Is the PM Youth Business Loan interest-free?

Loans up to Rs. 500,000 are interest-free, while higher amounts carry low subsidized markup.

5. How long does loan approval take?

Processing time usually takes a few weeks, depending on document verification and bank assessment.

Final Words

The PM Youth Business Loan 2026 online apply facility opens a powerful door for Pakistan’s youth to turn business ideas into reality. With low markup, flexible repayment, and government support, this program offers a rare chance to build a sustainable income source.

If you have a strong business idea and meet the eligibility criteria, apply online as early as possible and take your first step toward becoming a successful entrepreneur in 2026.